By Barbara Nuss, CPA

Profit Soup

What must you get right to be financially successful? At Profit Soup, we LOVE numbers. You probably expect us to say something like this:

“To avoid financial problems, study your numbers.”

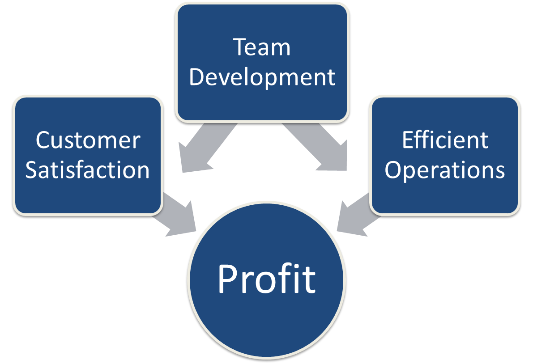

Academically, it’s a sound approach. Realistically, you cannot build a profitable, sustainable enterprise without a skilled and passionate team living out a selling culture with efficient operations.

Financial statements and KPIs represent the voice of your business, giving you feedback on how well the team is managing the important business functions. Having a sound, regular financial review routine is an important function of a profitable enterprise. It points you to problem areas you need to investigate, such as rising costs and timely price adjustments.