By Barbara Nuss, CPA

Profit Soup

What must you get right to be financially successful? At Profit Soup, we LOVE numbers. You probably expect us to say something like this:

“To avoid financial problems, study your numbers.”

Academically, it’s a sound approach. Realistically, you cannot build a profitable, sustainable enterprise without a skilled and passionate team living out a selling culture with efficient operations.

Financial statements and KPIs represent the voice of your business, giving you feedback on how well the team is managing the important business functions. Having a sound, regular financial review routine is an important function of a profitable enterprise. It points you to problem areas you need to investigate, such as rising costs and timely price adjustments.

<!--more Continue reading

-->

Still, you cannot fix financial problems by reading lagging indicators on financial reports. It’s too late. The best approach is to avoid financial mistakes to begin with. Who does that? People do!

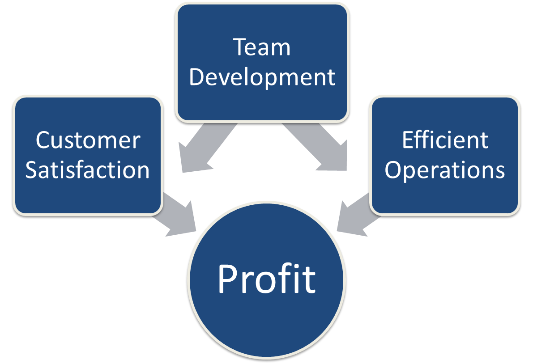

Consider this diagram. People drive customer satisfaction and efficient operations. Happy customers and efficient operations drive profit.

Teams fill many essential functions in a business. Whether or not you have people holding these titles, you have people filling all these roles:

-

- CEO (Usually the owner)

- General Manager

- Purchasing Manager

- IT Manager

- Chief Financial Officer (CFO)

- Human Resources Manager

- Sales Manager

- District Manager (for multi-unit)

While most small to medium businesses (SMBs) do not have a person for each role, someone wears each hat. Owners and general managers wear most of them. With or without the title, someone is wearing every hat (and a few people wear many hats), and these people share in the ownership of the big financial mistakes and the solutions or tactics for avoiding them.

How is your team development, customer satisfaction, and operational efficiency? Financial mistakes and profit derailers are often rooted in these areas. To assess your own operation, request our Big Mistakes Self-assessment Team Brainstorming Guide.

At Profit Soup, we got to know the financial makeup of many businesses in our work developing and delivering financial training. Here are the top 10 financial mistakes I see SMBs make, along with some tips for avoiding them. See if any of these seem familiar.

Big financial mistakes and how to avoid them Click To Tweet

Top 10 Financial Mistakes

Mistake #1: JUST DRIFTING – NO PLAN

Tip: Each year, assess your long-term goals for growth, enterprise value, and transition of ownership.

Mistake #2: JUST DRIFTING – NO GOALS

Tip: Set short-term goals and a budget that aligns with your long-term goals.

Mistake #3: OPERATING IN STEALTH MODE

Tip: Share your goals with your team. Or better yet, set the goals with your team. Together, plan the tactics to back up the goals. Then, here’s the important part. Be transparent enough with your numbers that the team can measure their progress against the goals. Be clear about what defines top performance for their roles and share information so they can assess their own results.

Mistake # 4: LACKING A GENUINE SALES CULTURE

Tip: Prioritize living a true sales culture – every day, every way. Nurture experts prioritize customer satisfaction and keep selling KPIs in the forefront of their minds.

Mistake # 5: HAVING A MYOPIC FOCUS

Tip: Diversify your sales mix. Maximize upselling to lift annual revenue per customer. Think beyond what you did last year. Explore new opportunities to expand your range of products and services in alignment with your business model.

Mistake #6: ACCEPTING FINANCIAL GARBAGE

Tip: Use a Chart of Accounts that is appropriate for your industry, franchise system, or business model. Hire a good bookkeeper. Don’t do your own books (or make a family member do it) if you (they) aren’t qualified.

Mistake #7: NEGLECTING MONTHLY FINANCIAL REVIEW

Tip: Don’t assume looking at financials at year-end is often enough. You must review accurate financial statements and KPIs EVERY MONTH. If you don’t have accurate monthly financials, see point 6!

Mistake #8: IGNORING THE BUSINESS AS AN INVESTMENT

Tip: Use capital wisely. Leave sufficient cash in the business to manage debt repayment and reinvest in growth. Borrow with intention, funding opportunities that drive revenue and enterprise growth.

Mistake #9: SETTLING FOR SUBPAR STAFF

Tip: Develop and empower your team. Promote a sense of ownership and accountability within your staff. Identify and eliminate distractions that hinder your ability to focus on priorities

Mistake #10: WASTING TIME ON NON-ESSENTIALS

Tip: Don’t just be busy. That’s easy. Prioritize. Identify and eliminate distractions that hinder your ability to focus on priorities.

Avoiding Mistakes That Bring Down Your Bottom Line

We recommend a four-step process.

Step 1: Assess Your Situation: What Big Mistakes Kill Your Bottom Line?

Use the ten common mistakes as food for thought. But don’t limit your answer to just those. Brainstorm with your team to assess your situation. Together, list the big mistakes that crush or have the potential to kill the bottom line.

Step 2: Brainstorm Solutions With Your Team

Take on the problems one at a time. Consider what causes them. Then, produce as many ideas as possible to avoid or correct the problems.

Identify the problems quickly. You know what they are. Spend most of your time brainstorming solutions.

Step 3: Prioritize Your Issues

Refer to the Problems (Big Mistakes) you listed in your brainstorming activity. What are the most critical issues to work on today? Here are some questions to help you decide.

-

- What concerns you most? What will happen if you don’t do anything about it?

- What has the most potential to improve profits?

- Which issues could be attacked immediately for a quick win?

- Which issues cascade to other problems? E.g., Fix them and you’re fixing other things, too.

- If you could fix just one thing in the business, what would it be?

- What is keeping you from moving forward? What’s getting in the way?

- How does the issue impact your long-term goals for the business?

It may not be feasible to fix everything at once. Choose just one or two issues to prioritize.

Step 4: Identify Your Call to Action

For each priority you identify, establish a goal and a tactical plan to make improvements. Determine who will do what, and by when. Establish your cadence for check-ins and keep the team focused on the plan. Check out these additional resources for more insights into setting appropriate and keeping the team on track.

Related blogs:

Related Podcasts:

Get Your Team Involved – Download the free Self-Assessment with Team Brainstorm Guide

Take this topic beyond an interesting blog. Get your team involved in identifying the financial derailers in your business. We’ve got some free tools to help.

Sign up and download our free Self-Assessment with The Team Brainstorm Guide.

The Guide includes these tools:

-

- BIG Financial Mistakes Self-Assessment

- Financial Cause and Effect Diagram

- Step-by-step instructions

Using the Guide leads you and your team to pinpoint issues in team development, customer satisfaction, operations, and profitability, and to explore solutions to ensure you fix (or avoid) Big Financial Mistakes.

![]()

About the Author

Barbara Nuss

Founder and president of Profit Soup. She is a teacher, business advisor, passionate advocate for better business thinking and frequent speaker at franchise and association conventions.